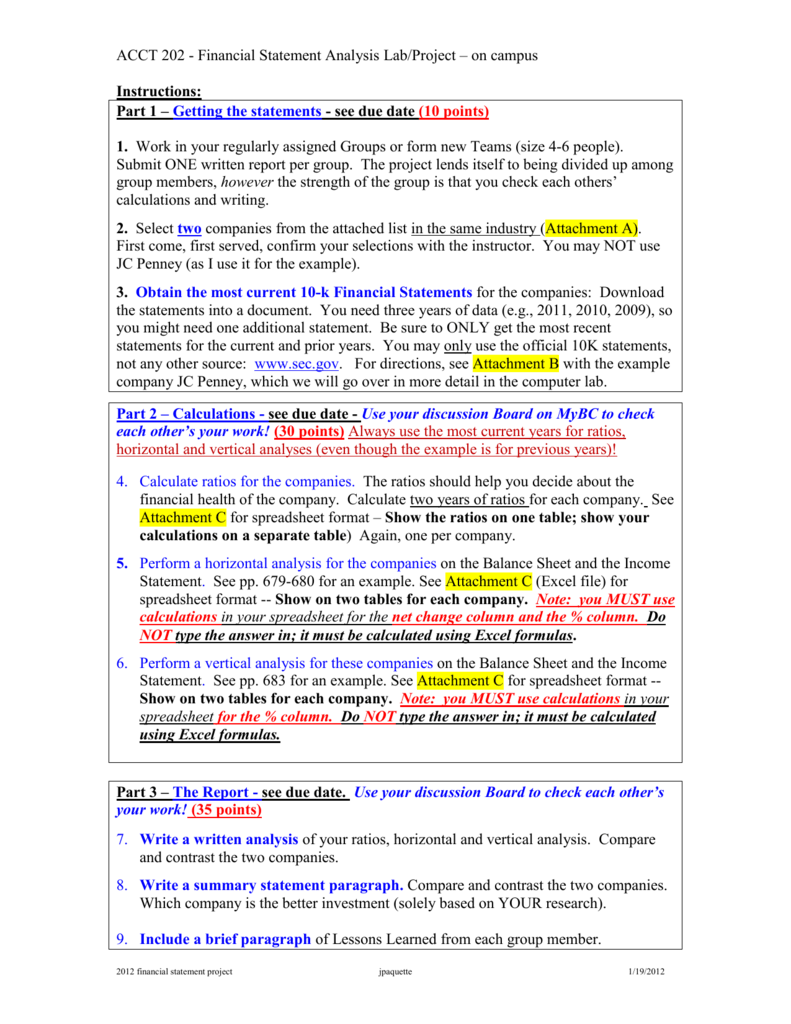

Financial statements: Overview – Balance sheet

But, opportunities are, you didn’t begin your own company so you might be hunched over a calculator financial report dropbox paper every night. That’s where an accountant comes in handy. A skilled bookkeeper can prepare your monetary declarations for you, so you can make smart monetary choices without all the tedious documentation. Plus, when it’s time to submit your income taxes, you’ll know your financials are 100% detailed and appropriate, ready to be handed off to your accounting professional.

We’ll do your bookkeeping for you, prepare monetary declarations every month, and provide you access to the Bench app where you can keep tabs on your financial resources. Discover more.

Idea in Short In spite of tightening financial report dropbox paper policies, such as Sarbanes-Oxley and Dodd-Frank, investors, board members, and executives are still unable to count on financial statements in order to make smart choices about whether to purchase or obtain a business, for several factors. Initially, flawed estimates sneak in to financial declarations, Lam Research even when made in excellent faith.

And lam research third, executives continue to face strong incentives to manipulate the numbers. In this article, the authors analyze the impact of recent financial policies and think about new strategies to fight the video gaming of efficiency numbers. In a best world, financiers, board members, and executives would have full self-confidence in companies’ monetary statements.

What Is Financial Reporting?

And they might make sensible choices about whether to buy or get a business, thus promoting the efficient allotment of capital. Sadly, that’s not what takes place in the real life, for several reasons. First, corporate monetary statements necessarily depend upon estimates and judgment calls that can be extensively off the mark, even when made in great faith.

Finally, managers and executives consistently experience strong incentives to deliberately inject error into financial declarations. In the summer of 2001, we released a post in these pages (“Tread Gently Through These Accounting Minefields”) created to help shareholders recognize the ways in which executives utilize business monetary reporting to control outcomes and misrepresent the true worth of their companies.

6 years later, the monetary world collapsed, resulting in the adoption of the Dodd-Frank guidelines and nexocorporativo.net.Br a global effort to fix up distinctions between U.S. and global accounting regimes. Despite the raft of reforms, business accounting remains dirty. Companies continue to find ways to video game the system, while the introduction of online platforms, which has dramatically changed the competitive environment for all businesses, has actually cast into plain relief the drawbacks of traditional efficiency indications.

How to Write a Financial Report (with Pictures) – wikiHow

How to Write a Financial Report (with Pictures) – wikiHowWe also take a look at the more insidiousand maybe more destructivepractice of controling not the numbers in financial reports but the operating decisions that affect those numbers in an effort to attain short-term results. Discovering ways to reduce such habits is a difficulty for the accounting professionbut one that new analytic techniques can address.

Financial Statements 101

Financial report a minecraf issue Examples For Monthly Statements & Reports

Financial report a minecraf issue Examples For Monthly Statements & ReportsIssue 1: Universal Standards Back in 2002, the world appeared to be on the brink of an accounting transformation. An initiative was under way to produce a single set of international accounting requirements, with the supreme aim of joining the U.S. Normally Accepted Accounting Concepts (GAAP) and the International Financial Reporting Standards (IFRS) that European countries remained in the process of adopting.

Today, financial report dropbox paper a minimum of 110 countries around the globe use the system in one kind or another. But in a broad sense, convergence has stalled, and further substantive modifications appear unlikely in the future. To be sure, development has actually been made, however understanding the real worth of a firm and comparing company accounts across nations continue to be significant challenges.

The analysis of investment targets, acquisitions, or rivals will in a lot of cases continue to require comparison of financial statements under two distinct accounting programs: financial report dropbox paper Pfizer versus Glaxo, Smith, Kline, Exxon versus BP, Walmart versus Carrefourin each case, one business utilizes GAAP and the other uses IFRS. The effect on results is hardly minor.

Prior to it was acquired by the U.S. firm Kraft, financial report dropbox paper in 2009, it reported IFRS-based profits of $690 million. Under GAAP those revenues amounted to only $594 millionalmost 14% lower. Similarly, financial report dropbox paper Cadbury’s GAAP-based return on equity was 9%a full 5 percentage points lower than it was under IFRS (14%). Such differences are big enough to change an acquisition decision.

Where Financial Reporting Still Falls Short

Each has its own system of guideline and compliance, and in lots of nations (particularly in the fastest-growing emerging regions) compliance and enforcement are weak. The quality and independence of the accounting occupation are also often patchy. Outcomes under GAAP versus IFRS can be different enough to alter an acquisition decision.

India and China are significant examples. So while several countries, amongst them Australia and Canada, have actually embraced the total, untainted variation of IFRS, it’s constantly worth inspecting to see if a company of interest has actually adopted a truncated or bastardized variation. Problem 2: Revenue Recognition Earnings recognition is a tricky piece of the regulatory puzzle.

The agreement for that service or product often includes future upgrades whose costs can not be anticipated at the time of the sale. For that reason, it is impossible to determine just how much earnings the sale will generate. Under existing GAAP rules, if there is no unbiased method to measure such costs beforehand, a service is not enabled to tape any income from that sale up until all upgrade requirements have been delivered and their costs are knownwhich might take a few years.

Additional Info about save paper

In doing so, the companies solve an accounting problembut compromise their ability to adopt a conceivably more appealing bundling strategy. The outcome is a perverse system in which accounting rules affect the way business is done, instead of report on business’ efficiency. The imperfections of revenue-recognition practices have actually likewise triggered companies to significantly use informal measures to report financial efficiency, especially for services running in the virtual space.

SAMPLE MONTHLY FINANCIAL REPORT

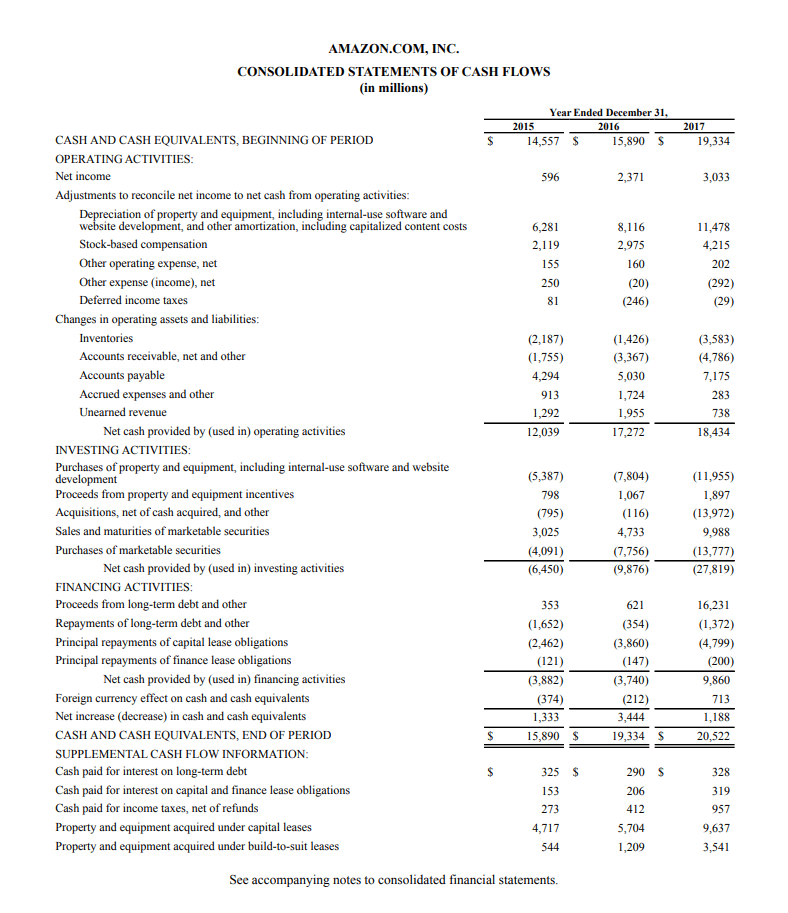

Unsurprisingly, these business soon started to embrace alternative ways to report on incomes. For instance, in 2015 Twitter reported a GAAP net loss of $521 million; it also used not one, however 2 non-GAAP earnings steps that revealed favorable income: adjusted EBITDA of $557 million and non-GAAP net income of $276 million.