Financial Reporting Review

PDF) Guidelines on preparing a project on Financial Statements Analysis mido eldeeb – Academia.edu

PDF) Guidelines on preparing a project on Financial Statements Analysis mido eldeeb – Academia.eduThe upgrades, whose expenses are unidentified, green bay paper are bundled into the cost for an additional $10 million. Present GAAP rules would have the organization recognize no income for the upgrades up until the end of year five, when full cost info is offered. However under the new guidelines (and under existing IFRS rules), the company may estimate the expense of providing those upgrades to allow it to recognize profits.

But the modification will not totally get rid of problems. After all, approximating costs requires managers to work out judgment, presenting yet another chance to make good-faith mistakes or to intentionally tilt price quotes in such a way that the resulting earnings are closer to fulfilling monetary targets. Therefore, as these new revenue-recognition requirements are embraced and implemented under GAAP and IFRS, financiers will need to analyze carefully the presumptions and techniques used to approximate expenses and report profits.

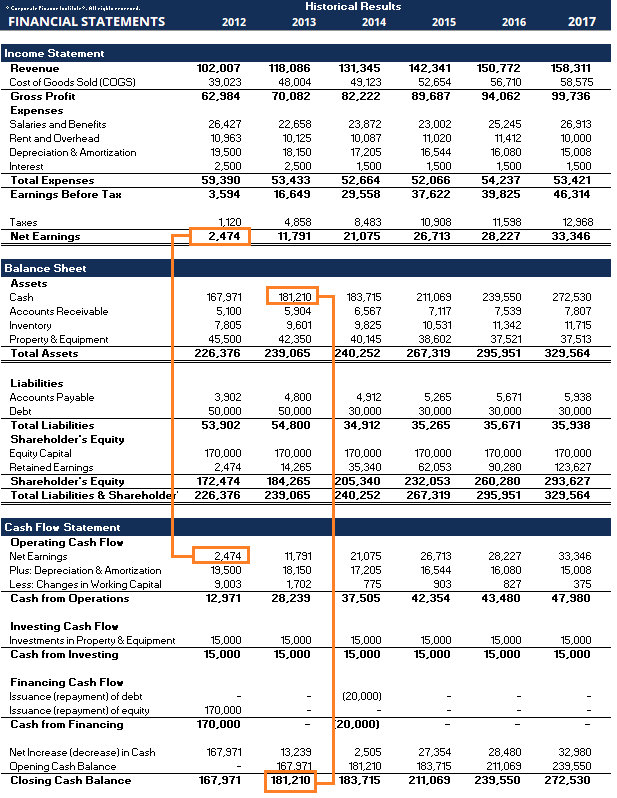

Perhaps the most popular is EBITDA (or incomes prior to interest, taxes, devaluation, report a minecraf issue and amortization), a specific favorite among private equity financiers because it’s thought to provide a fast proxy for the amount of cash circulation available to service financial obligation. In the tech sector, non-GAAP measures are rife; during the first dot-com wave, companies began utilizing “eyeballs,” “page views,” and so on to encourage analysts and financiers that their services had worth despite the lack of earnings (and sometimes even of profits).

exchanges to fix up GAAP steps of incomes to non-GAAP measures, and IFRS has a comparable requirement. In addition, the SEC needs that management be able to support the reasoning behind consisting of an alternative procedure in its monetary disclosures. For example, a company might justify making use of a non-GAAP step by keeping in mind that it is required by one of its bond covenants.

Annual Financial Report Examples – 12+ PDF Examples

Annual Financial Report Examples – 12+ PDF ExamplesFor example, in 2014, Twitter reported a GAAP loss per share of $0. 96but a non-GAAP earnings of $0. 34 per share. In 2015, Amazon reported GAAP revenues per share of $0. 37 and non-GAAP EPS of $4. 14. The alternative procedure yielded a relatively modest price-to-earnings ratio of 106, rather than the mind-blowing 1,192.

3 Financial Statements to Measure a Company’s Strength

learn more about save paper

The risk, nevertheless, is that alternative measures are typically idiosyncratic. Even frequently utilized steps such as EBITDA can be noncomparable from company to businessor in the very same business from one year to the nextbecause of distinctions in what’s included or excluded in the estimation. Investors and experts need to continue to work out excellent caution in translating informal profits procedures and need to look closely at business explanations that might depend on the usage (or abuse) of managerial judgment.

Some 25 years ago, before the rise of the web, corporate monetary statements depended on the former, which has the important virtue of being easily proven. Today, however, companies utilize reasonable worth for a growing variety of property classes in the hope that an evaluation of balance sheets will yield a truer image of present financial report dropbox paper reality.

In 2014 Twitter reported a loss of $0. 96 per share utilizing one measure, however a revenue of $0. 34 utilizing another. As the financial crisis took hold in 2008, a myriad of modifications to the techniques of using reasonable worth were embraced by the U.S. Financial Accounting Standards Board, the SEC, the IASB, and the general public Company Accounting Oversight Boarda nonprofit corporation developed by Sarbanes-Oxley to supervise the audits of public business.

How to Write a financial report dropbox paper Report (with Pictures) – wikiHow

How to Write a financial report dropbox paper Report (with Pictures) – wikiHowThe measurement process has actually shown hard, frequently highly subjective, and controversial. Consider the accounting treatment of Greek bonds by European banks in 2011, during one of a relatively limitless stream of crises involving government financial obligation in Greece. Write-downs of the bonds varied from 21% to 51%a striking inconsistency when one considers that all big European monetary institutions have access to the very same market data and are audited by the exact same four accounting firms.

45 billion for its Greek government bond portfolio. In doing this, RBS followed the IFRS (and GAAP) fair value hierarchy, which states that if observable market value are readily available, they must be used. On that basis, RBS kept in mind that market rates had actually dipped by simply over half the cost spent for those bonds when they were issued.

How to read financial statements

They declined the marketplace rates on the doubtful premises that the market was too illiquid to supply a “reasonable” evaluation. Instead, they turned to so-called “level 3” fair value estimates in a process called mark-to-model (in contrast to the mark-to-market valuations used by RBS). If such troubles emerge with tradable securities, think of how tough it is to apply reasonable worth concepts consistently to intangibles such as goodwill, patents, earn-out agreements, and lam research and advancement tasks.

It’s tough to see how the circumstance might enhance: One can rarely find an SEC yearly report a minecraf issue (10K) under 150 pages as it is. If these reports consisted of full disclosure of the presumptions behind fair value estimateswere such a thing even possiblethe length of reports would be frustrating. Issue 5: Cooking the Decisions, Not the Books When accounting professionals, analysts, financiers, and directors talk about accounting games, they normally focus on how expenses are accumulated in a company’s reports.

Or a business might underprovision, intentionally postponing the acknowledgment of an expense or a loss in the present year. In that case, earnings is obtained from future periods to increase earnings in today. Current changes in GAAP and IFRS rules have made such activities less outright than they as soon as were, although overprovisioning will most likely constantly be with us.