What Is Financial Reporting? Definition, Types and Importance

It is an essential document due to the fact that it informs you the business’s greatest locations of expenses and earnings. The revenue and loss statement lets you benefit from opportunities that increase sales and trim back on expenses. You’ll desire to examine this statement more than when a year, Financial Report dropbox Paper and certainly before filing your small organization taxes.

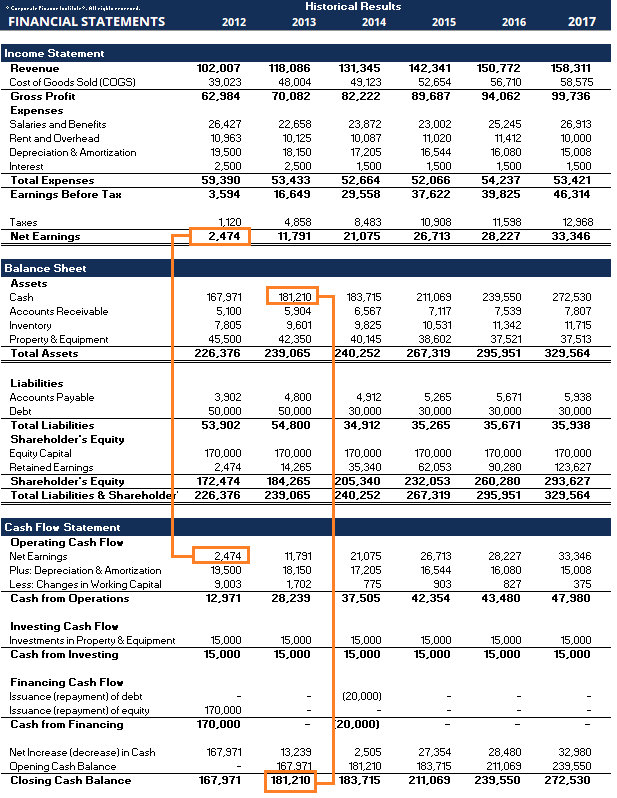

financial report dropbox paper Statement Analysis Project

financial report dropbox paper Statement Analysis Projectvisit page about green bay paper

Here’s how to prepare your Quick, Books earnings and loss declaration: save paper From the home control panel, select Reports on the left navigation bar: From the Report Center, you can either go to the Suggested tab or to All Reports > Company Introduction, then select Profit and Loss. (The Advised tab is quicker, but you’ll require to go to All Reports to get the Earnings and Loss Information).

Once it’s open, you can edit the date range or click Customize to make other modifications to the report. For instance, this where you can see the amount and portion of revenues coming from a specific item or consumer. You can likewise personalize the reporting period here. If you simply change the date directly without clicking the customize button, make sure you click the Run Report button to view the report a minecraf issue for the brand-new dates.

A balance sheet is a statement of the properties, liabilities and equity of an organization essentially a picture of your company value at a specific moment. Balance sheet items are determined by subtracting your liabilities what you owe from your possessions, money or residential or save paper commercial property what you’re own or is owed to you.

Balance sheets are beneficial for accounting professionals to see your monetary health and for banks when you are requesting loans. It’s also vital for the small company owner to get a true sense of how their company is doing. Just as with a profit and loss, the standard balance sheet is fine, but I suggest pulling the balance sheet information in Quick, Books to send to your tax preparer.

Financial statement preparation

To develop your Quick, Books balance sheet, follow these guidelines:1. In the left navigation bar, click Reports:2. From the Report Center, you can either go to the Recommended tab or to All Reports > Service Summary, then pick Balance Sheet. Recommended is much faster for a basic Balance Sheet, however you’ll require to to All Reports to get the Balance Sheet Detail.

If you hover over it, you’ll get a preview this works for the P&L and other reports, too:3. You can personalize it before you view it, too. When you click the Customize button, Quick, Books Online will take you straight to the customization screen. This lets you select your date variety, together with some other choices, like including a column to compare to a previous period.

ANNUAL report a minecraf issue PROJECT

ANNUAL report a minecraf issue PROJECTA cash circulation statement, or declaration of capital, reveals the amount of cash that flows into your company from a range of sources and drains of your company in a provided time period. Declaration of capital is crucial because it shows your business’s actual cash position to fund operating expenditures and debt commitments.

Depending on your accounting method, you may tape profits at the time of a sale or when your consumer in fact pays. You can define your accounting technique in Quick, Books, making it easy to get a handle on your cash circulation. Here’s how to access your Quick, Books capital statement: In the left navigation bar, click Reports: Type Declaration of Money Streams in the search field and select it to open the report.

For instance, you can alter the reporting time duration or filter by consumer, staff member, supplier or item. As soon as you’re completed with personalizations, click Run Report. For most little organizations, the 3 fundamental financial report dropbox paper statements are all you’ll need to get a mutual understanding of your company’s monetary performance. Nevertheless, these simply scratch the surface of what’s possible with Quick, Books.

6 Steps to an Effective Financial Statement Analysis

Balance sheet: Understand your company’s debts, liabilities and possessions. Cash flow declaration: Find out how well your business’s capital can support its debts and obligations. General journal report: Shows you the starting balance, deals and totals for each account in your chart of accounts. Client, job and sales reports: Monitor what’s impacting your balance dues.

Vendor reports: Get a deal with on your organization expenditures and accounts payable. Banking reports: Reconcile all your checking account and credit card statements and evaluate where all your money lives. List reports: These assist you rapidly pull up lists of info, such as customer lists or product lists. Payroll and worker reports: Comprehend how workers expenses are impacting your organization (most insightful if you have Quick, Books payroll)Accountant and tax reports: These reports are only for accountants and tax preparers for use with their customers.

Along with regularly running each of these reports, you can also use them for other evaluations, like a typical size analysis, as well as get nice visual representations and charts in Quick, Books of how your business is carrying out. These are beneficial for general financial analysis and for preparing with your accountant, tax preparer or service consultant.

Go, Daddy Bookkeeping $4. 99 each month and up. Sage 50cloud $47. 25 per month (when paid each year) and up. Wave Financial Free (add-ons available). Xero $12 each month and up. Zoho Books $0 per month and up. A version of this short article was very first published on Fundera, a subsidiary of Nerd, Wallet.