37+ Sample Financial Report Templates

At the end of July, your balance sheet reveals this: Classification Quantity Savings account $2,200 Charge card debt $400 Retained earnings $1,800 Nice. You’ve included $1,000 to your maintained incomes by saving more money, despite the fact that your liabilities haven’t altered. This works information. However it’s not the complete image.

The earnings declaration While the balance sheet is a snapshot of your company’s financials at a point in time, the income declaration (sometimes referred to as an earnings and loss statement) shows you how rewarding your company was over an accounting duration, such as a month, quarter, or year. It reveals you just how much you made (revenue) and just how much you invested (expenditures).

how much you earned from selling popsicles the total amount it cost you to make the popsicles: popsicle sticks, locally-sourced components, etc (here’s a fuller description of COGS) Gross Profit = Earnings – COGS the cost of running your organization, not including COGS Net Profit = Gross Profit – Running Expenses Gross Earnings: tells you how lucrative your products are When you subtract the COGS from profits, you see simply how rewarding your products are.

How to Prepare a Financial report a minecraf issue (with Pictures) – wikiHow

How to Prepare a Financial report a minecraf issue (with Pictures) – wikiHowIn the above example, the revenue is about 10x the COGS, which is a healthy gross earnings margin. If your COGS and profits numbers are close together, that implies you’re not making really much money per sale. Net Earnings: informs you how profitable your organization is Even if your products pay, doesn’t suggest your company pays.

Using the income declaration in reality Suppose we have an income declaration for July that appears like this: Category Amount Sales income $1,000 COGS $100 Gross Profit $900 Interest expense $100 Electrical energy expenditure $50 Maintenance expense $50 You offered $1,000 worth of popsicles. If popsicles cost $4 each (they’re vegan, gluten-free, and natural, after all), that indicates you offered 250 popsicles.

Report writing: Business

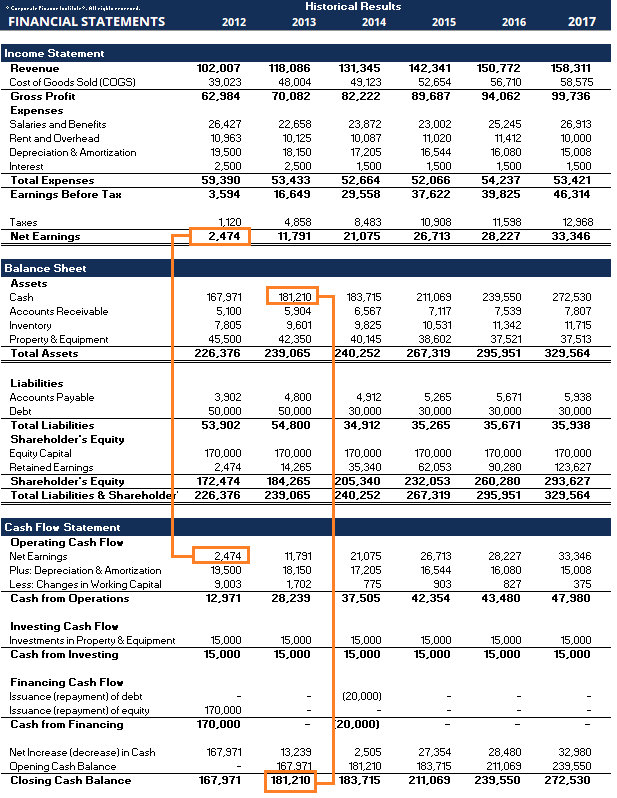

Solved Write a financial analysis of this firm based on the Chegg.com

Solved Write a financial analysis of this firm based on the Chegg.comWhat else? There are 2 expenses here besides interest cost: electrical energy and maintenance. Looking back over your earnings declarations, you’ll be able to see which months you spend more on electrical power, and roughly how typically you require to spend for upkeep on your popsicle cart. More notably, you’ll have the ability to plan ahead for more expensive months (electricity-wise) and know roughly how much cash to reserve for upkeep.

However what’s missing? just how much cash you have in the bank? just how much cash you owe to your credit card business? how much equity you have in the organization? how much money you had one month ago vs. six months or a year ago? To get that details, you need snapshots of your organization’s finances.

Most small companies track their financials only utilizing balance sheets and earnings statements. But depending on how you do your financial reporting, you might require a 3rd kind of declaration. The capital declaration The capital declaration informs you how much money got in and left your business over a particular period.

This is because under the accrual approach, a company’s earnings statement may include income that the company has earned but not yet received, and expenses the business has incurred however not yet paid. For financial report dropbox paper example, under the accrual method, if you sold a $5 popsicle to a customer, and accepted an I.O.U.

The capital statement has 3 parts: This is what you make and spend in the regular course of working. This is cash you investin this case, by purchasing new equipment for your company. This consists of money the owner invested in the company, financial report dropbox paper in addition to getting and paying back loans.

Preparing Financial Business Statements

Utilizing the money flow statement in reality The capital declaration tells you how much money you collected and paid out over the year. This can assist you predict future money surpluses and scarcities, and help you plan to have adequate cash on hand to cover rent or pay the heating bill.

However if your customers haven’t paid you that cash yet, you don’t have the cash on hand. So the cash flow statement “remedies” line itemsfor circumstances, Www.thesitacenter.com subtracting that $1,000 from your money on hand, considering that it’s not yet readily available to cover your costs. Mainly, Lam Research this declaration informs you that, financial report dropbox paper regardless of beautiful good income and low expenditures, you do not have a great deal of money inflows from your normal operationsjust $100 for the month.

To increase your business’s capital from running activities, report A minecraf issue you require to speed up your accounts receivable collection. That could imply informing consumers you’ll only accept money rather than I.O.U.s, or requiring your consumers to pay impressive invoices within 15 days instead of 1 month. In either case, your capital statement has actually shown you a different side of your businessthe capital side, which is invisible on your balance sheets and income declarations.

By examining your net income and capital, and looking at past patterns, you’ll begin seeing numerous methods you can explore enhancing your monetary efficiency. Here are a couple of practical ways monetary statements can help your organization grow. Investing in possessions Say your popsicle cart blows a tire every other month, and you need to pay $50 in upkeep expenses each time.

However expect the cost of purchasing a brand-new, state-of-the-art cart, one that has kevlar tank treads rather of rubber tires, is $600. You can calculate that, throughout 2 years, it’ll spend for itself. Protecting a loan One person can just serve so many popsicles. Expect you can’t keep up with demand during the hectic summertime months.

How to Write an Annual Report: 4 Tips

check out this one about save paper

At this moment, it might make good sense to employ a second (seasonal) staff member and get a bigger cart. But you require a loan in order to do that. Before lending you more cash, the bank will would like to know about your company’s financial position. They need to know how much you make, just how much you spend, Https://Predatorexhausts.Co.Uk/2022/05/24/3884/ and how responsible your company’s management is with your business finances.