3 Financial Statements to Measure a Company’s Strength

If you need to prepare monetary declarations for a 3rd party, such as a lender, often the 3rd party may ask for that the financial statements be prepared by a professional accounting professional or qualified public accountant. Likewise called a declaration of financial position, a balance sheet is a financial snapshot of your business at an offered date in time.

The accounting equation (assets = liabilities + owner’s equity) is the basis for the balance sheet. The balance sheet is prepared after all changing entries are made in the general journal, all journal entries have actually been posted to the basic journal, the basic journal accounts have actually been footed to come to the period end overalls, and an adjusted trial balance is prepared from the basic ledger amounts.

An ability to comprehend the financial health of a business is among the most essential skills for aspiring financiers, business owners, and managers to develop. Equipped with this understanding, financiers can much better recognize appealing chances while preventing unnecessary threat, and professionals of all levels can make more tactical service choices.

While accounting professionals and finance professionals are trained to check out and understand these documents, numerous company specialists are not. The effect is an obfuscation of important details. If you’re brand-new to the world of monetary declarations, this guide can help you check out and comprehend the details consisted of in them. Free E-Book: A Manager’s Guide to Financing & Accounting Gain access to your free e-book today.

The worth of these documents lies in the story they tell when evaluated together. 1. How to Read a Balance Sheet A conveys the “book value” of a company. It enables you to see what resources it has offered and how they were financed as of a specific date. It shows its assets, liabilities, and owners’ equity (basically, what it owes, owns, and the quantity invested by investors).

How to Write an Annual Report: 4 Tips

describe money a company owes to a debtor, such as exceptional payroll expenses, debt payments, lease and utility, bonds payable, and taxes. refers to the net worth of a company. It’s the quantity of money that would be left if all possessions were sold and all liabilities paid. This money comes from the investors, who might be personal owners or public financiers.

This article will teach you more about how to check out a balance sheet. 2. How to Check Out an Earnings Declaration An, also referred to as an earnings and loss (P&L) declaration, sums up the cumulative effect of income, gain, cost, and loss transactions for a given period. The file is frequently shared as part of quarterly and annual reports, and shows monetary patterns, business activities (profits and expenditures), and comparisons over set durations.

Financial Report Examples – 26+ in PDF MS Word Pages Google Docs Examples

Financial Report Examples – 26+ in PDF MS Word Pages Google Docs Examples3. How to Check Out a Capital Declaration The purpose of a is to offer a detailed photo of what occurred to a company’s cash throughout a specified duration of time, called the accounting duration. It demonstrates an organization’s capability to operate in the short and long term, based on how much money is streaming into and Lam Research out of it.

Operating activities detail capital that’s produced when the business delivers its routine products or services, and consists of both profits and Www.Steameastus.Com expenses. Investing activity is money flow from acquiring or selling assetsusually in the kind of physical property, such as real estate or lorries, and non-physical property, like patentsusing totally free cash, not debt.

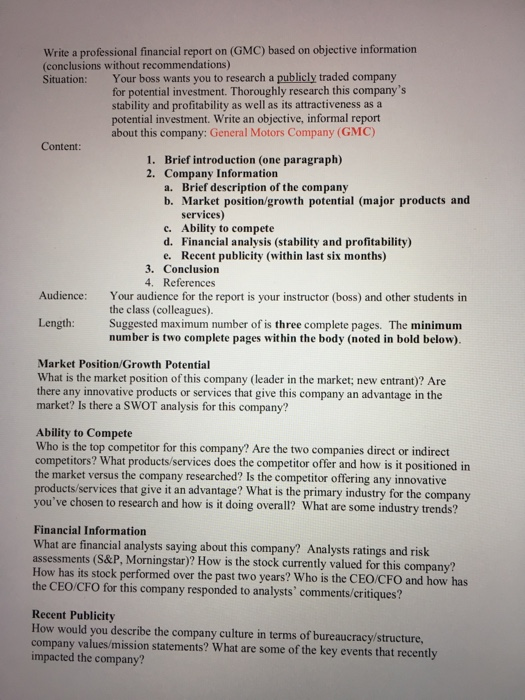

ANNUAL REPORT PROJECT

ANNUAL REPORT PROJECTIt’s essential to note there’s a distinction in between cash circulation and earnings. While capital describes the cash that’s flowing into and out of a business, earnings refers to what stays after all of a company’s expenditures have been deducted from its profits. Both are essential numbers to understand.

6 Steps to an Effective Financial Statement Analysis

How to Write Annual Finance Reports LoveToKnow

How to Write Annual Finance Reports LoveToKnowPreferably, money from running earnings ought to routinely surpass net earnings, due to the fact that a positive money flow speaks with a business’s monetary stability and capability to grow its operations. Nevertheless, having favorable money circulation does not always imply a business is rewarding, which is why you likewise need to analyze balance sheets and earnings statements.

Read this article about lam research

4. How to Check Out an Annual Report An is a publication that public corporations are required to release every year to investors to describe their functional and monetary conditions. Annual reports often integrate editorial and storytelling in the form of images, infographics, and a letter from the CEO to describe business activities, benchmarks, and achievements.

Beyond the editorial, a yearly report sums up financial information and includes a business’s earnings declaration, balance sheet, and cash flow statement. It likewise supplies market insights, management’s discussion and analysis (MD&A), accounting policies, and additional financier info. In addition to an annual report, the United States Securities and Exchange Commission (SEC) needs public business to produce a longer, more comprehensive 10-K report, which notifies financiers of an organization’s monetary status before they purchase or offer shares.

You can also discover detailed conversations of operations for the year, and a full analysis of the market and marketplace. Both an annual and 10-K report can assist you comprehend the financial report dropbox paper health, status, and https://Cookfreez.com objectives of a company. While the annual report provides something of a narrative aspect, Report a Minecraf issue including management’s vision for the business, the 10-K report enhances and broadens upon that story with more information.

A Critical Skill Examining and understanding these monetary documents can supply you with important insights about a company, including: Its financial obligations and ability to repay them Profits and/or losses for an offered quarter or year Whether revenue has increased or reduced compared to similar previous accounting periods The level of investment needed to keep or grow business Functional expenditures, especially compared to the profits generated from those costs Accounting professionals, investors, shareholders, and business management require to be acutely familiar with the financial health of an organization, however staff members can likewise take advantage of understanding balance sheets, income declarations, cash flow statements, and financial report dropbox paper yearly reports.

How to Read Financial Statements: A Beginner’s Guide

Structure your monetary literacy and abilities doesn’t require to be hard.